Bitcoin "Dip": Or, How to Panic Like Everyone Else

Bitcoin's "Dip": Or, How I Learned to Stop Caring and Embrace the Red Candle Okay, so Bitcoin's "dipped" to $94K. Again. Like we didn't see this coming. All the crypto bros were screaming "To the moon!" and "Hodl!" just last week, and now they're probably selling their kidneys to buy back in. Give me a break. "Extended its decline into the $94K–$96K macro demand region," one analysis says. Macro demand region? Is that what we're calling it now? Sounds like some marketing BS to me. More like the "Panic Selling Zone." And get this: "The market now sits at an important decision point." No sh*t, Sherlock! It's *always* at an important decision point. Either it goes up, or it goes down. Groundbreaking analysis, folks.Bitcoin's Dip: Blame Game or Market Rigging?

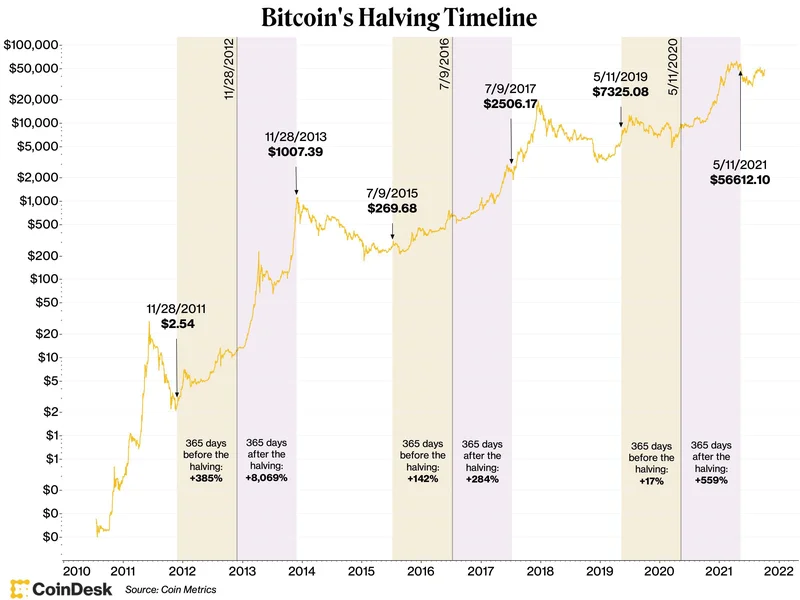

The Fed, the Whales, and the Usual Suspects So, *why* is Bitcoin doing its little nosedive? Everyone's got an opinion. "Outflows from crypto exchange-traded funds, long-term whale sales, escalating geopolitical tensions..." Blah, blah, blah. It's always something, isn't it? Never just good ol' fashioned market manipulation. Speaking of geopolitical tensions, does anyone else find it hilarious that we're trusting magic internet money to save us from, like, actual global conflict? Maybe I'm old fashioned, but shouldn't we be focusing on, you know, diplomacy instead of watching charts all day? One "expert" – and I use that term *very* loosely – says the four-year cycle narrative is to blame, with traders "spooked by the idea of a downturn every few years." Are you kidding me? People are actually surprised that a volatile asset is, you know, volatile? It's like being shocked that water is wet. And then there's the Fed. Oh, the Fed! Always screwing things up. They hint at rate cuts, then they don't, and suddenly Bitcoin's in the toilet. As if Jerome Powell gives a damn about your crypto portfolio.html Bitcoin's "Dead"? Yeah, I've Heard That One Before

Is This the End? (Spoiler Alert: No) Look, let's be real. Bitcoin ain't dying. Not today, not tomorrow. It'll bounce back, probably after I sell all mine at a loss. That's just how my luck works. But the idea that it's some kind of revolutionary, decentralized utopia? Please. It's just another way for rich people to get richer, and for the rest of us to gamble our savings away. "Sharp corrections are a regular part of any market," some crypto exec says. Offcourse, they're gonna say that. What else are they gonna say? "Yeah, it's all going to zero, sell everything now!"? They're trying to pump their bags just like everyone else. According to one report, crypto execs are speculating on what’s to blame as Bitcoin slumped under $94K. Crypto execs speculate on what’s to blame as Bitcoin slumped under $94K One last thing: I saw some analyst mention the "Net Unrealized Profit/Loss (NUPL) metric." What in the actual hell is that? Are we just making up words now? Sounds like something straight out of a bad sci-fi movie. So, What's the Real Story? ``` It's the Same Old Song and Dance ``` It's all a scam. Maybe not *intentionally*, but a scam nonetheless. The hype, the promises, the "revolutionary technology"... it's all a smokescreen for good old-fashioned greed. And we're all falling for it. Again.