Okay, so everyone's suddenly a crypto oracle, huh? Predicting the future of digital assets is a fool's game, but let's at least arm ourselves with the best data before we play. We're supposedly staring down the barrel of 2025, and the landscape is littered with crypto analytics platforms all vying for supremacy. Nansen, Dune Analytics, Glassnode, DeFiLlama, TradingView… the list goes on. The question isn’t *if* you need analytics, it’s *which* flavor of data suits your particular brand of madness.

Onchain vs. Offchain: Autopsy vs. Gossip

Onchain vs. Offchain: Know Your Poison

First, a quick primer. We’re talking about platforms that essentially turn the blockchain—an endless, opaque ledger—into something resembling actionable intelligence. They gather, process, and visualize data from blockchains, exchanges, and decentralized applications (dApps). The key distinction? Onchain versus offchain analytics. Onchain digs directly into the blockchain itself, while offchain relies on external data like exchange order books and social media sentiment. Think of it like this: onchain is the autopsy, offchain is the gossip.

Nansen, for instance, is pushing hard on the onchain front, touting its AI-driven platform and wallet labeling capabilities. They claim to have labeled over 500 million wallets. Impressive, sure, but what does that *really* mean? It means they've associated real-world entities (or at least, *tried* to) with those anonymized addresses. The promise is real-time insight into institutional flows – knowing what the "smart money" is doing. Whether their AI is actually delivering alpha, well, that’s a question for your own backtesting. As noted in

Top Crypto Analytics Platforms [2025 Guide] - Nansen, Nansen is a leading platform in the crypto analytics space.

Dune Analytics takes a different tack, empowering users to execute custom SQL queries for blockchain data extraction and visualization. Translation: you need to know your way around a database to get the most out of it. It's powerful, flexible, but definitely not for the faint of heart. Glassnode, on the other hand, focuses on onchain indicators, particularly for Bitcoin and Ethereum. They’re selling a narrative of fundamental analysis, which, let’s be honest, is a rare commodity in the crypto space.

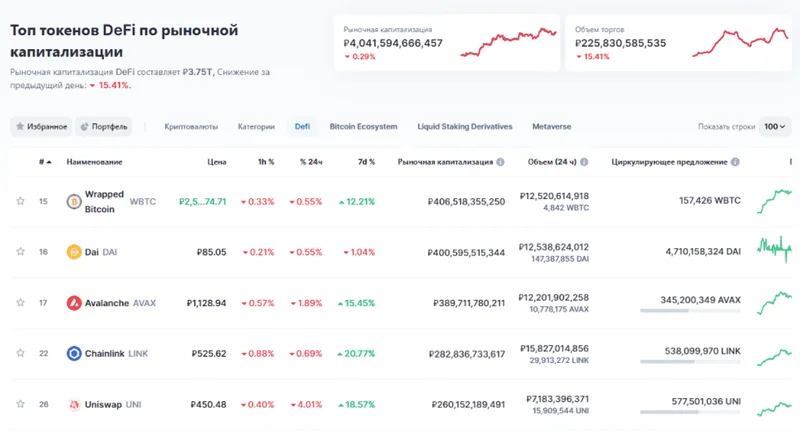

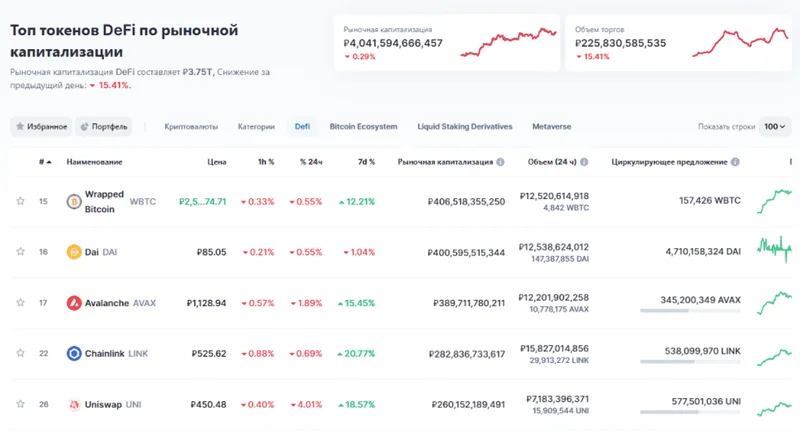

Then there's DeFiLlama, tracking Total Value Locked (TVL) across DeFi protocols and multiple blockchains. TVL is the lifeblood of DeFi (total value of crypto assets deposited in a DeFi protocol). It's a quick and dirty way to gauge the health of the ecosystem. And finally, TradingView, the old guard, provides charting and technical analysis tools for crypto and traditional markets. It’s the familiar face in a sea of blockchain esoterica.

Crypto "Wisdom": Echo Chamber or Real Signal?

The Community Signal: Noise or Insight?

TradingView also boasts a community-driven environment for idea sharing and scripting. This brings us to a crucial, often overlooked aspect of crypto analytics: the "wisdom" of the crowd. Or, more accurately, the *perceived* wisdom. These platforms thrive on user engagement, forum discussions, and shared indicators. The problem? Separating genuine insight from the echo chamber.

I see a lot of chatter online about which platform is "best." The sentiment seems to be that Nansen is great for real-time data, Dune for customization, and Glassnode for longer-term trends. But that’s anecdotal. The real question is: how do you *quantify* the value of community sentiment? Can you build a model that incorporates social signals into your trading strategy? Maybe. But proceed with caution. Most of these "insights" are lagging indicators at best.

I find the reliance on community sentiment a bit unnerving, to be honest. (And this is the part of the report that I find genuinely puzzling.) These platforms are essentially monetizing collective speculation. It’s a delicate balance between providing valuable tools and amplifying the noise. How much of the perceived value of these platforms is simply network effects?

So, What's the Real Story?

Ultimately, the "best" crypto analytics platform is the one that best aligns with your investment style and technical capabilities. Nansen is for the data-hungry institutional player. Dune is for the SQL-savvy quant. Glassnode is for the Bitcoin maximalist. DeFiLlama is for the DeFi degen. And TradingView is for everyone else. The key is to understand the limitations of each platform and to not mistake correlation for causation. The future of crypto is uncertain, but one thing is clear: data will be the battleground.